NOTES

BRUNVOLL HOLDING AS / BRUNVOLL HOLDING GROUP

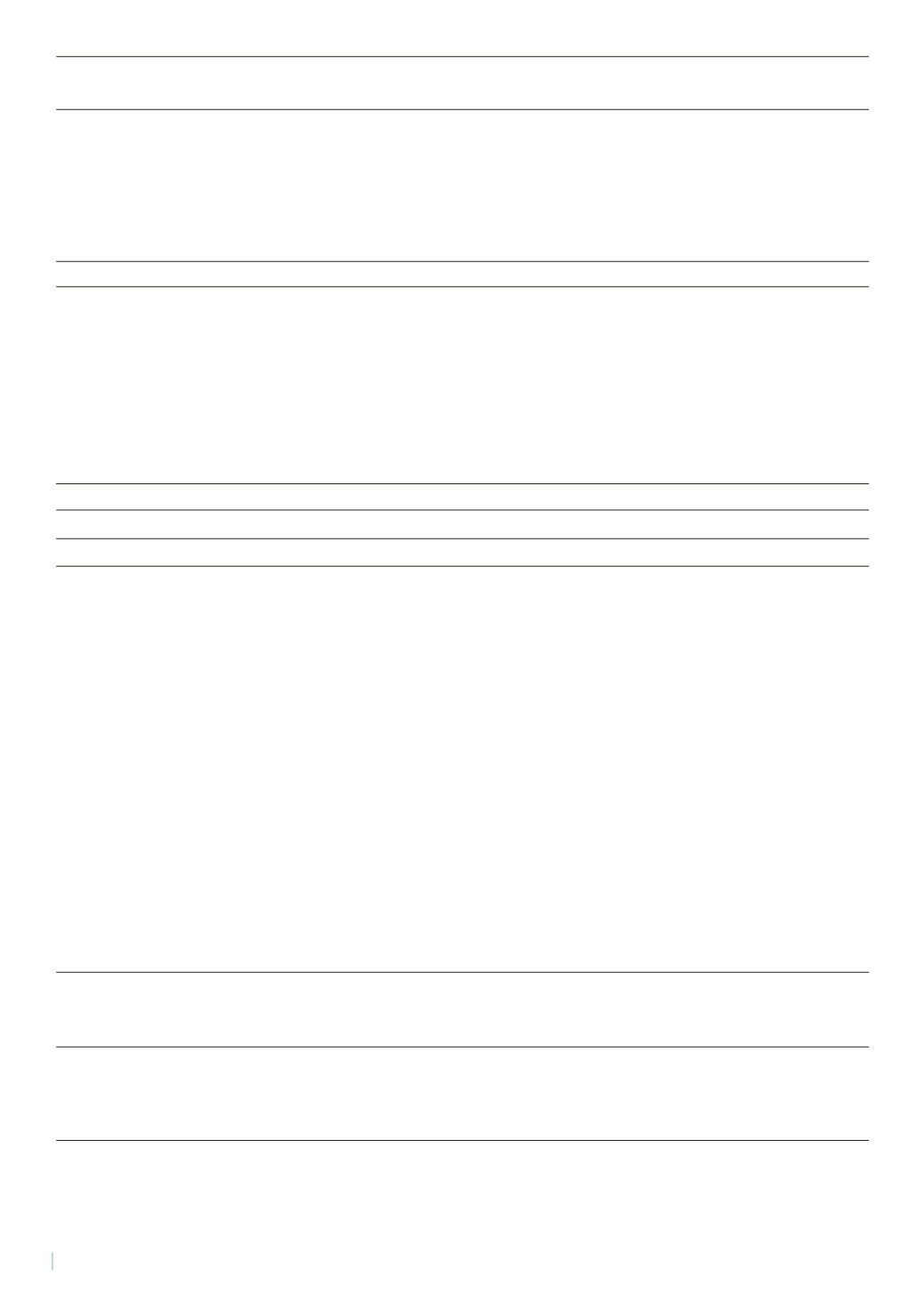

Note 6 – Specification of the basis for deferred tax/tax asset – Group

Temporary differences that affect tax payable

(Figures in NOK 1000)

Temporary differences related to:

31.12.2014

31.12.2015

Changes

Current assets

-7 416

-13 400

5 984

Non-current assets

14 106

10 575

3 530

Leasing agreements

-809

-604

-205

Deferred gains and losses

-1 228

-983

-246

Warranty and service provisions

-13 625

-7 775

-5 850

Pension assets (overfunding)

6 241

4 440

1 800

Allocation to pension liabilities

-2 050

-2 232

183

Other differences (AFP pension liabilities)

0

0

0

Tax loss carry-forward

-1 023

-59

-963

Total temporary differences

-5 803

-10 038

4 235

Carying amount of deferred tax assets

1 567

2 509

1 143

Deferred tax on excess value

On acquisition of the subsidiary Høvdingbygget Årø AS, an excess value of the purchase price over the book value, attributable

to the property, was calculated at TNOK 32 198. Deferred tax was calculated on this amounting to TNOK 2 254 (discounted to

present value 7%). The excess value is amortized over 50 years and deferred tax is reversed on a straight-line basis in line with the

amortization. The residual excess value at 31 December 2015 amounts to TNOK 30 588 and the remaining deferred tax on this

amounts to TNOK 2 141. Reversed tax on the residual value amounts to NOK 45 078 over the amortization period of 50 years.

Deferred tax on excess value has not been offset against deferred tax assets.

Note 7 – Tax on ordinary profit – parent company

Specification of tax base for the year:

(Figures in NOK 1000)

Profit before tax

51 322 597

+ Permanent differences

-27 588

+ Change in temporary differences

182 560

+ Received Group Contribution

50 000 000

- Applied loss carried-forward

913 224

= Basis for tax payable

46 554 451

Tax payable 27%

12 569 705

+/- Tax effect on Group Contribution given

- 1 350 000

Tax payable in the Balance Sheet

11 219 702

+/- Tax effect on Group Contribution given

1 350 000

+/- Change in deferred tax assets

197 279

+/- Estimation deviation due to changed tax percentage

50 248

= Ordinary tax expense in the income statement

-12 817 229

48

Annual Report 2015