Notes

Note 3 continued

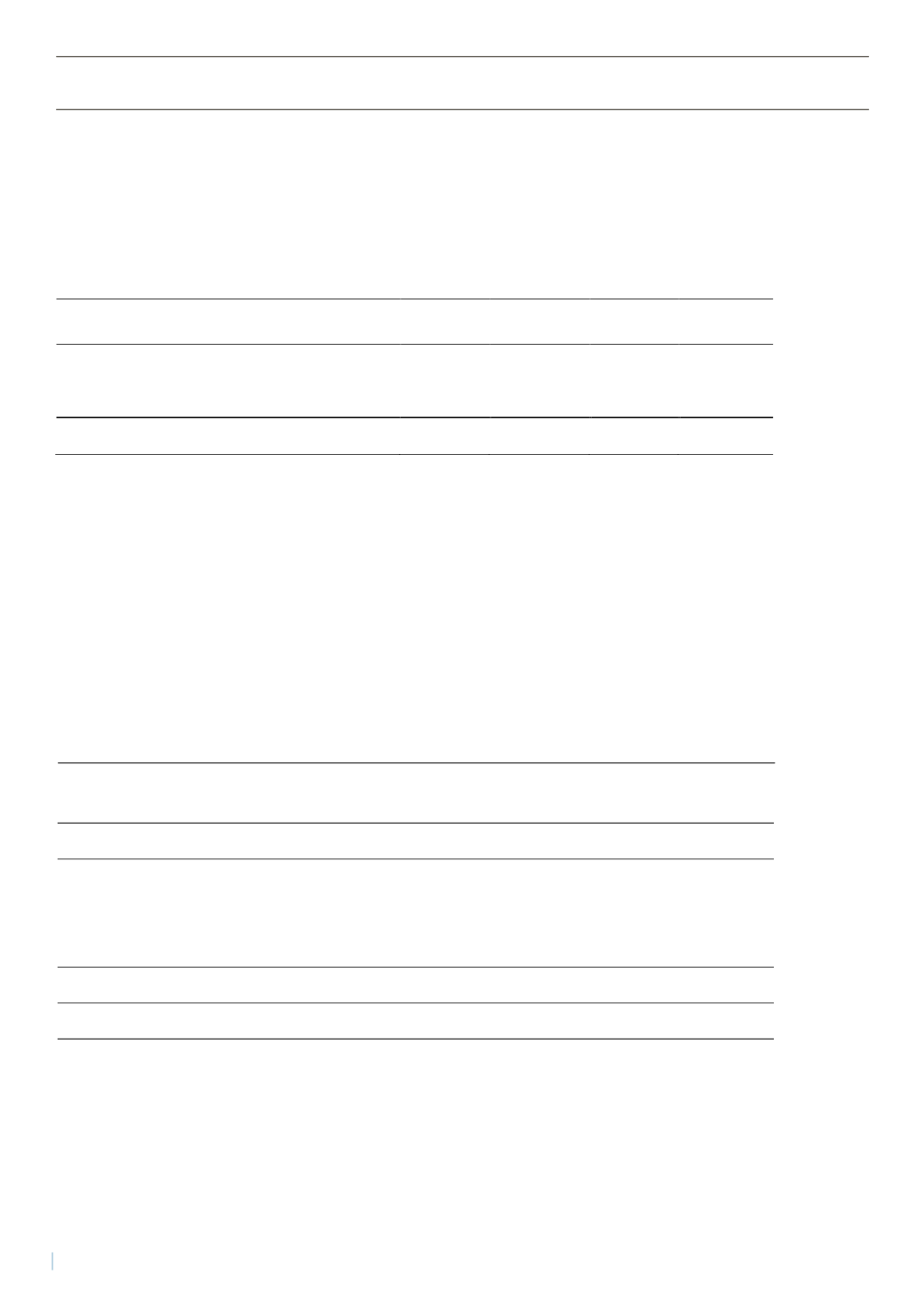

Funded Scheme

Unfunded scheme

Funds > liabilities

Funds < liabilities

2014

2013

2014

2013

Discounted present value of accrued pension liability

including growth in pay

50 508 261

47 308 211

0

278 640

Pension assets

39 406 705

38 411 593

Net pension liability over-/(underfunded)

-11 101 556

-8 896 618

0

-278 640

Employer

’

s contribution on net pension liability

-1 565 319

-1 254 423

0

-39 288

Net pension liability including employer

’

s

contribution

-12 666 875

-10 151 042

0

-317 928

Unrecognized actuarial loss (gain)

16 571 000

15 463 359

0

-435 549

Actuarial gains and losses, employer

’

s contribution

2 336 511

2 180 334

0

-61 412

Capitalized assets / (liabilities) including employer

’

s

contribution

6 240 636

7 492 652

0

-814 889

(*) including salary adjustments, pension increase and adjustment of the basic amount in the National Insurance.

The table above does not include information about the defined-contribution plan. The amount contributed during the

year was NOK 5 839 032. In addition, at 31 December 2014 NOK 2 049 749 including employer

’

s national insurance

contributions was allocated to a pension agreement with the CEO.

Note 4 - Depreciation of non-current assets -

Group

Intangible

Machinery Other equipment,

Land,

Total

(Figures in NOK 1000)

assets

and plant fixtures, tools and buildings and

office machines

real estate

Acquisition cost at 1/1

7 491

131 468

87 926

338 365 565 250

+ Investment

8 242

4 439

15 912

28 593

- Disposals

3 692

3 692

Acquisition cost at 31/12

7 491

139 710

92 365

350 585 590 151

Accum. depr./impairment at 1/1

2 172

70 490

53 495

117 306 243 463

+ Ordinary depreciation

1 872

10 816

8 096

13 740

34 523

+ Extraord. impairment

-6 500

-6 500

- Reversal of depreciation

1 409

1 409

Accum. depr./impairment at 31/12

4 044

81 306

61 591

123 136 270 077

Carrying amount at 31/12

3 447

58 404

30 774

227 448 320 074

Percentage for ord.depreciation

25

5-20

20-25

0-8

Lease expense of assets

2

3 344

4 056

7 402

Under machinery and plant, two machines have been capitalized with finance leases. The acquisition cost of these is

NOK 24 714 642. The book value is NOK 8 201 500. The annual depreciation of these amounts to NOK 2 466 000.

At the year-end, facilities under construction were recognized with a total of NOK 39 277 328.

Notes

Note 3 continued

Funded Scheme

Unfunded scheme

Funds > liabilities

Funds < liabilities

2014

201

2014

2013

Discounted present value of accrued pension liability

including growth in pay

50 508 261

47 308 211

0

278 640

Pension assets

39 406 705

38 411 593

Net pension liability over-/(underfunded)

-11 101 556

-8 896 618

0

-278 640

Employer

’

s contribution on net pension liability

-1 565 319

-1 254 423

0

-39 288

Net pension liability including employer

’

s

contribution

-12 666 875

-10 151 042

0

-317 928

Unrecognized actuarial loss (gain)

16 571 000

15 463 359

0

-435 549

Actuarial gains and losses, employer

’

s contribution

2 336 511

2 180 334

0

-61 412

Capitalized assets / (liabilities) including employer

’

s

contribution

6 240 636

7 492 652

0

-814 889

(*) including salary adjustments, pension increase and adjustment of the basic amount in the National Insurance.

The table above does not include information about the defined-contribution plan. The amount contributed during the

year was NOK 5 839 032. In addition, at 31 December 2014 NOK 2 049 749 including employer

’

s national insurance

contributions was allocated to a pension agreement with the CEO.

Note 4 - Depreciation of non-current assets -

Group

Intangible

Machinery Other equipment,

Land,

Total

(Figures in NOK 1000)

assets

and plant fixtures, tools and buildings and

office machines

real estate

Acquisition cost at 1/1

7 491

131 468

87 926

338 365 565 250

+ Investment

8 242

4 439

15 912

28 593

- Disposals

3 692

3 692

cquisition cost at 31/12

7 491

139 710

92 365

350 585 590 151

Accum. depr./impairment at 1/1

2 172

70 490

53 495

117 306 243 463

+ Ordinary depreciation

1 872

10 816

8 096

13 740

34 523

+ Extraord. impairment

-6 500

-6 500

- Reversal of depreciation

1 409

1 409

Accum. depr./impairment at 31/12

4 044

81 306

61 591

123 136 270 077

Carrying amount at 31/12

3 447

58 404

30 774

227 448 320 074

Percentage for ord.depreciation

25

5-20

20-25

0-8

Lease expense of assets

2

3 344

4 056

7 402

Under machinery and plant, two machines have been capitalized with finance leases. The acquisition cost of these is

NOK 24 714 642. The book value is NOK 8 201 500. The annual depreciation of these amounts to NOK 2 466 000.

At the year-end, facilities under construction were recognized with a total of NOK 39 277 328.

NOTES

BRUNVOLL HOLDING AS / BRUNVOLL HOLDING GROUP

(*) including salary adjustments, pension increase and adjustment of the basic amount in the National Insurance.

The table above does not include information about the defined-contribution plan. The amount contributed during the

year was NOK 5 839 032. In addition, at 31 December 2014 NOK 2 049 749 including employer’s national insurance

contributions was allocated to a pension agreement with the CEO.

Note 4 - Depreciation of non-curre t assets - Group

Under machinery and plant, two machines have been capitalized with finance leases. The acq isition cost of these is

NOK 24 714 642. The book value is NOK 8 201 500. The annual depreciation of these amounts to NOK 2 466 000.

At the year-end, facilities under construction were recognized with a total of NOK 39 277 328.

42

Annual Report 2014