NOTES

BRUNVOLL HOLDING AS / BRUNVOLL HOLDING GROUP

Note 5 - Other equity - parent company

Note 5 - Other equity - Group

Note 6 - Specification of the basis for deferred tax / tax asset – parent company

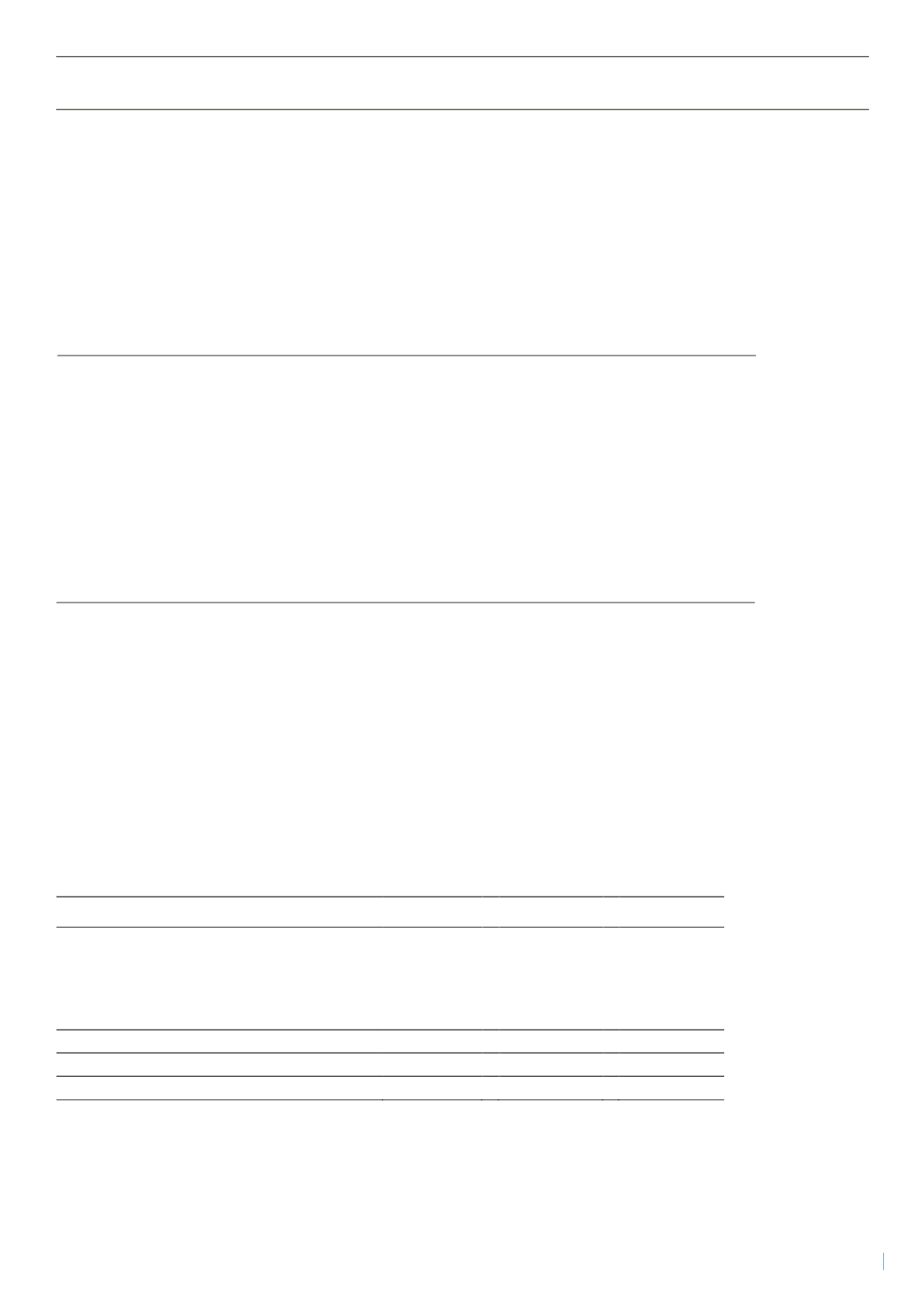

Notes

Note 5 - Other equity -

parent company

Change in equity

Retained

Total

(Figures in NOK 1000)

Share Capital

Premium

earnings

equity

Equity 31 December 2013

19 440

6 135

286 719

312 294

From other transactions

-175

-175

Net profit for the year (after provision for dividend)

1 783

1 783

Equity 31 December 2014

19 440

6 135

288 327

313 902

Note 5 - Other equity -

Group

Change in equity

Retained

Total

(Figures in NOK 1000)

Share capital

Premium

earnings

equity

Equity 31 December 2013

19 440

6 135

496 342

521 917

Net profit for the year (after provision for dividend)

49 095

49 095

Dividend

-24 840

-24 840

Equity 31 December 2014

19 440

6 135

520 597

546 172

Note 6 - Specification of the basis for deferred tax / tax asset –

parent company

Temporary differences that affect tax payable

(figures in NOK 1000)

Temporary differences related to:

31.12.2013

31.12.2014

Changes

Operating assets

-280

280

Provision for pension liabilities

-1 867

-2 050

183

Tax loss carry-forward

-55

-913

857

Total temporary differences

-1 922

-3 242

1 320

Deferred tax asset

-519

-876

357

Change in differences that affect tax payable

463

Notes

Note 5 - Other equity -

parent company

Change in equity

Retained

Total

(Figures in NOK 1000)

Share Capital

Premium

earni gs

equity

Equity 31 December 2013

19 440

6 135

286 719

312 294

From other transactions

-175

-175

Net profit for the year (after provision for dividend)

1 783

1 783

Equity 31 December 2014

19 440

6 135

288 327

313 902

Note 5 - Other equity -

Group

Change in equity

Retained

Total

(Figures in NOK 1000)

Share capital

Premium

earni gs

equity

Equity 31 December 2013

19 440

6 135

496 342

521 917

Net profit for the year (after provision for dividend)

49 095

49 095

Dividend

-24 840

-24 840

Equity 31 December 2014

19 440

6 135

5 0 597

546 172

Note 6 - Specification of the basis for deferred tax / tax asset –

parent company

Temporary differences that affect tax payable

(figures in NOK 1000)

Temporary differences related to:

31.12.2013

31.12.2014

Changes

Operating assets

-280

280

Provision for pension liabilities

-1 867

-2 050

183

Tax loss carry-forward

-55

-913

857

Total temporary differences

-1 922

-3 242

1 320

Deferred tax asset

-519

-876

357

Change in differences that affect tax payable

463

Notes

Note 5 - Other equity -

parent company

Change in equity

Retained

Total

(Figures in NOK 1000)

Share Capital

Premium

earnings

equity

Equity 31 December 2013

19 440

6 135

286 719

312 294

From other transactions

-175

-175

Net profit for the year (after provision for dividend)

1 783

1 783

Equity 31 December 2014

19 440

6 135

288 327

313 902

Note 5 - Other equity -

Group

Change in equity

Retained

Total

(Figures in NOK 1000)

Share capital

Premium

earnings

equity

Equity 31 December 2013

19 440

6 135

496 342

521 917

Net profit for the year (after provision for dividend)

49 095

49 095

Dividend

-24 840

-24 840

Equity 31 December 2014

19 440

6 135

520 597

546 172

N t - Specification of the basis for d ferred tax / tax asset –

parent company

Temporar i

ces that affect tax payable

(figures in NOK 1000)

Temporary differences related to:

31.12.2013

31.12.2014

Changes

Operating assets

-280

280

Provision for pension liabilities

-1 867

-2 050

183

Tax loss carry-forward

-55

-913

857

Total temporary differences

-1 922

-3 242

1 320

Deferred tax asset

-519

-876

357

Change in differences that affect tax payable

463

43